Since 2005, the UK has experienced a steady decline in demand for electricity as consumer habits change, energy efficient regulations have come in and there has been widespread adoption of energy-efficient lighting. But the overall demand for energy has increased as the population grows, and people are living longer.

In a race to decarbonise the energy sector and move away from coal and oil to reach net zero, it is predicted demand for electricity will rapidly increase as we switch over and it becomes one of the primary sources of power. ** The speed of this change will be influence by the adoption of electric-powered systems for more carbon-efficient homes as well as electric vehicles, amongst other new emerging technologies.

For us to meet the growing demand for electricity, the UK will require significant investment in renewable energy infrastructure. This will also help us become less dependent on overseas providers of power, which are heavily influenced by geo-political factors. ***

For the infrastructure to work well, it needs to be able to deliver the power when and where it’s needed. Demand for energy varies both by region and by time of year, as our consumption habits change. Understandably, it peaks in the winter when the need for heating and lighting is strongest.

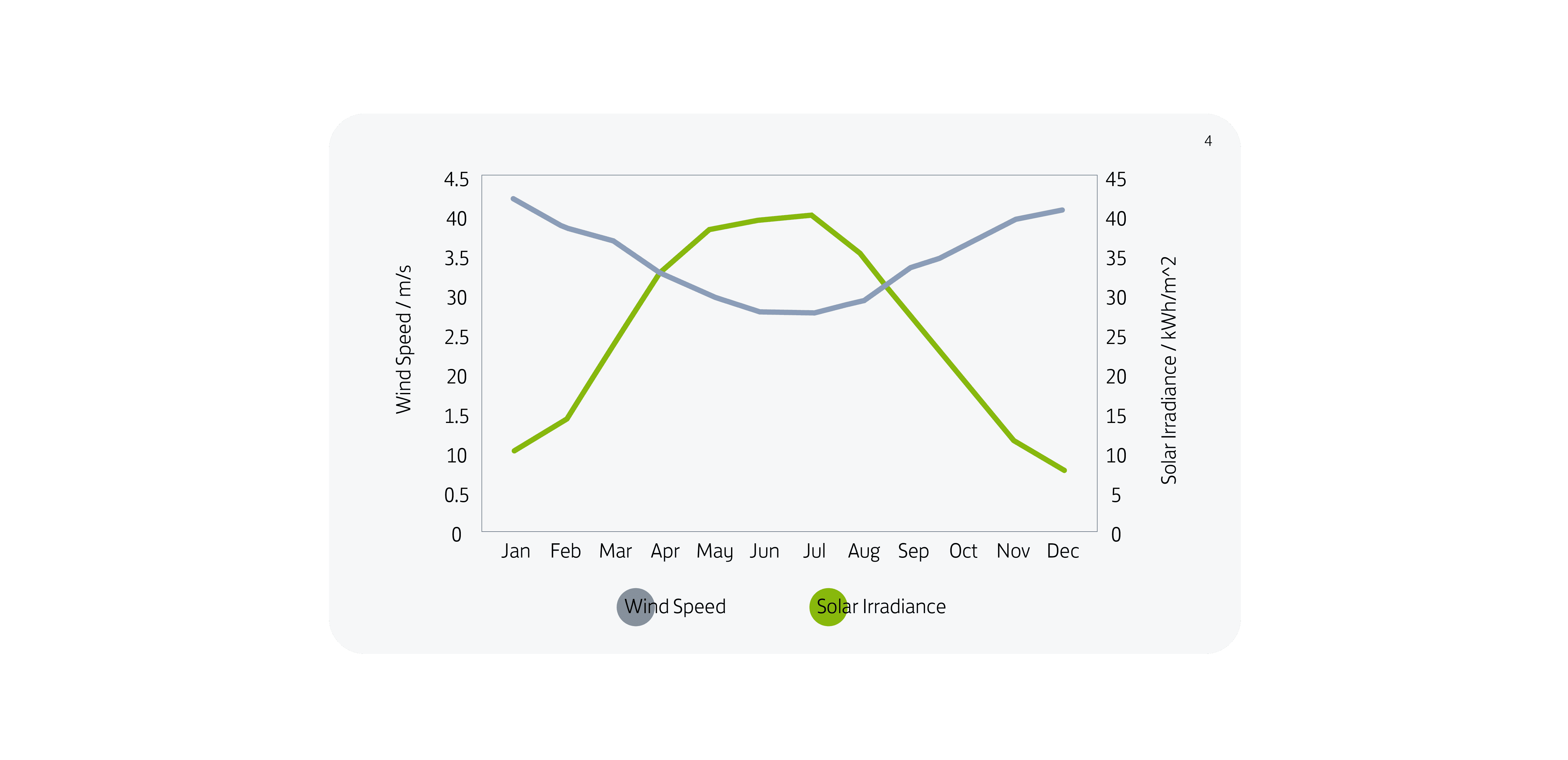

So, to revisit our initial question, when does UK wind speed peak? The answer is January. So how do we responsibly power our homes during the Summer when the wind speed drops? The balance is achieved by investing in solar power, which has its best months at the opposite time to wind.

****

As a growing influential investor in both wind and solar, we are helping to provide a consistent source of renewable energy over the course of the whole year. Funded by Sedgwick Trading Ltd, accessible to investors through our Adapt Inheritance Tax (IHT) Portfolio product, our energy portfolio currently contains 49 sites across the UK, producing 120 gigawatt hours per year of electricity. This is enough to power 32,000 homes for a year! The portfolio includes a range of technologies including ground and rooftop solar photovoltaics as well as onshore wind farms.

Blackfinch Energy are working with retail investors money to leave a positive legacy: The expansion of clean, renewable energy sources for future generations.

To date, we can power 32,000 homes for a year from our 49 sites located throughout the UK

The diversification of our energy investments allows the team to work with experienced developers at different stages of projects. Most recently, the team are working on a second phase of a site in Scotland. Taking construction risk on this subsidy-free project enables the team to realise the development potential of the site and achieve a greater return in addition to social economical benefits such as job creation. The project was particularly interesting as the construction phase took place during the pandemic, presenting a unique set of challenges which the team successfully managed.- Quiz time – when do you think it’s most windy in the UK? Have a think on that, whilst we explore what’s happening in the production and consumption of electricity in the UK.

The energy team is working on a number of exciting future investments into UK wind and solar renewable energy, exploring a range of risks and potential returns across planning, construction and operational assets. As an experienced team with deep technical knowledge and strong relationships across the sector, they are well placed to carefully select different opportunities which complement the portfolio, continuing to balance the risks and opportunities of wind and solar together, further bolstering the provision of clean energy to the nation.

If you’re interested in being part of the change to renewable energy and would like your investments to have an impact in this area, then speak to one of our team today about our Adapt IHT Portfolio. Adapt IHT Portfolio allows you to invest towards a greener future whilst also receiving tax benefits.

Your capital is at risk. The value of your investments could go up as well as down and you may not receive back the full amount you invest.

*Source: UK: monthly electricity consumption 2021 | Statista

**Source: Modelling 2050: electricity system analysis (publishing.service.gov.uk)

***Source: Major acceleration of homegrown power in Britain’s plan for greater energy independence - GOV.UK (www.gov.uk)

****Source: Blackfinch Energy portfolio, May 2022